The Evolution of Cryptocurrency: Understanding the Fundamentals of Crypto, Hardware Wallets, Staking, and Fork

In recent years, cryptocurrency has experienced a remarkable surge in popularity, with new users joining the ecosystem every day. At the heart of this growth is the increasing adoption of digital assets such as Bitcoin (BTC), Ethereum (ETH), and other altcoins. However, navigating the complex world of cryptocurrencies requires a solid understanding of its core components. In this article, we will delve into three essential topics: crypto, hardware wallets, staking, and fork.

What is Crypto?

Crypto, short for cryptocurrency, refers to digital or virtual currencies that use cryptography for security and are decentralized, meaning they are not controlled by any government or financial institution. The first and most well-known example of a cryptocurrency is Bitcoin (BTC), launched in 2009 by an individual or group using the pseudonym Satoshi Nakamoto.

Cryptocurrencies operate on a decentralized network, allowing users to send, receive, and store funds without the need for intermediaries like banks. Transactions are recorded on a public ledger called a blockchain, which ensures the integrity and security of transactions through cryptography and complex algorithms.

Hardware Wallets

One of the most crucial components of cryptocurrency investment is the hardware wallet. A hardware wallet is a physical device that securely stores cryptocurrencies offline to prevent hacking or loss. These wallets typically use advanced cryptographic techniques to protect user funds and ensure that they are not accessed by unauthorized parties.

There are several types of hardware wallets available, including:

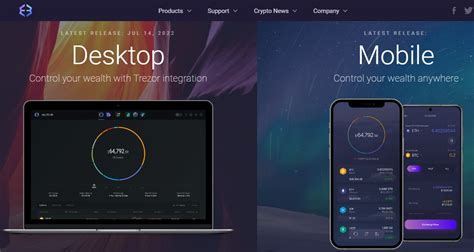

- Desktop Wallets: Desktop wallets such as Electrum or Ledger Live allow users to manage their crypto portfolios on their computers.

- Mobile Apps: Mobile apps like MyEtherWallet or Trust Wallet enable users to access their cryptocurrency funds from their mobile devices.

- Seed Phrases: Some hardware wallets, like Trezor or MetaMask, use seed phrases to generate a backup code for secure recovery in case of device loss.

Staking

Staking is a process where coins are held and verified by a network of nodes across the blockchain, securing the network and maintaining its integrity. When a user stakes their cryptocurrencies, they essentially become part of the network’s validation process, ensuring that transactions are correctly recorded on the blockchain.

In staked cryptocurrencies, users can earn interest or rewards in exchange for their participation in the validation process. Some popular staking platforms include:

- Binance Staking: Binance, a leading cryptocurrency exchange, offers a mobile app and website for users to stake their coins.

- SushiSwap Staking: SushiSwap, a decentralized exchange (DEX) platform, allows users to stake their ETH or other tokens to earn rewards.

Fork

A fork is an event in which the blockchain splits into two separate branches, each containing the same blocks of code but with different versions of the software. F forks typically occur due to disagreements among developers about the direction of development or new ideas that diverge from a previous version.

For example:

- Bitcoin Fork: The original Bitcoin (BTC) forked from an earlier version called « Shelley » in 2017, resulting in the creation of Litecoin (LTC).

- Ethereum Merge: Ethereum’s mainnet is currently undergoing a fork, where its underlying blockchain will be upgraded to enable the transition from the proof-of-work (PoW) consensus algorithm to the proof-of-stake (PoS) consensus algorithm.

Conclusion

As cryptocurrency continues to grow in popularity and adoption, it is essential for users to have a solid understanding of these core components.