Cryptom market volatility: guide to pumping, bear and relative force index (RSI)

The cryptocurrency world has always been known for its high volatility, but recent market trends have emphasized the importance of understanding different technical indicators to navigate this fast environment. In this article, we deepen the volatility of the cryptomus market: a guide to the pump, bear and relative strength (RSI) index, which is a trio -used tool used by traders and investors.

What is the bomb?

The pump is a short time due to a significant increase in prices in the cryptocurrency market, usually due to investor market feelings or enthusiasm. During this phase, prices increased rapidly, leaving bulls (supporting buyers) before bears (opposite sellers). The bomb can provide traders and investors the opportunity to take advantage of the moment, but it is necessary to understand that these times are naturally volatile.

Karhu: Market Drops

The bear is a reduction or decrease in cryptocurrency prices. It is characterized by a decrease in negotiations, lower heights and below. During this phase, Bears (opposite vendors) are trying to put the price back to the support level, so traders must be careful to buy immersion.

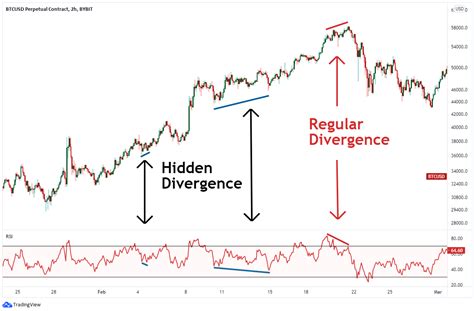

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a popular technical indicator that measures the power or weakness of the recent price movement in stock. It calculates the amount of prices over time and offers opinions of market opinions. The RSI varies from 0 to 100, higher values indicate extra conditions.

Here are the main features of RSI:

* purchased over (80-100):

indicates that the price has increased rapidly and may be due to repair.

* Albourte (30-70): suggests that the price is in the fall or rhythm of the bear, which makes a good time to sell.

By applying the cryptocurrency market, RSI can help traders identify possible purchases. Ascending RSI reading suggests that prices can continue to increase while reading shows that prices have fallen.

How to use pump, bear and rsi

indicators

This allows you to include these indicators in a commercial strategy:

- Pump: Identify possible pump opportunities, finding a significant increase in prices in the cryptocurrency market. Remember that these periods can be volatile, so it is necessary to be a solid risk management plan.

- Bear: Focus on the identification of potential trends of bears or invoice in the cryptocurrency market. Be careful to buy immersion as this can lead to a rhythm of spinning.

- RSI: Use the RSI indicator for your diagrams to identify extra and underestimated conditions. This can help you make conscious trade decisions and avoid making impulsive purchases or sales.

Conclusion

Understanding the pump, bear and relative force index (RSI) is crucial for traders and investors in the cryptocurrency market. By identifying these models, you can develop a more effective negotiation strategy than risk the risk and reward. Be sure to always define realistic expectations, use appropriate risk management techniques, and remain unacceptable in a constantly changing market environment.

Responsibility Exemption: This article is intended for information purposes only and should not be considered as investment counseling. The cryptocurrency market is very unstable and it is necessary to conduct its own research before making investment decisions.