Understanding market dynamics in cryptographic space

In recent years, the world of cryptocurrency in recent years has been recorded a meteoric growth, transforming from the niche market into a global phenomenon. As the number of cryptocurrencies and projects based on blockchain, both investors, enthusiasts and industry professionals increases to understand the basic dynamics that drives this market.

What is cryptocurrency?

Cryptocurrencies are digital or virtual currencies that use cryptography for safe financial transactions. Bitcoin is the most commonly recognizable cryptocurrency, but there are over 5,000 other cryptocurrencies, each with own unique features, functions and cases of use.

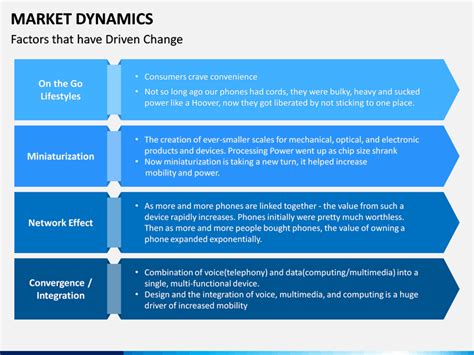

market dynamics

The cryptographic market is characterized by fast price fluctuations, often powered by factors such as:

- supply and demand : Balance between the total supply of cryptocurrencies and the demand of investors, traders and users.

- Market moods : Collective emotions and opinions of market participants that can affect prices.

- Regulatory environment : government policy, regulations and regulations that affect the adoption and use of cryptocurrencies.

- Technological progress : Innovations in blockchain technology, intelligent contracts and other related areas that can improve or disrupt existing markets.

Key market indicators

Several key indicators help measure market dynamics:

- Price : Current cryptocurrency value determined by market forces.

- volume

: The number of transactions made on the stock exchange that reflects the activity of purchase and sales.

- Trading volume indicator (TVI)

: The indicator compares the volume of rotation to price movements.

- Liquid rush : The speed at which prices move in favor of bulls (investors who buy).

- Besidish Momentum : The speed at which prices move against bulls.

cryptocurrency categories

The cryptographic market can be divided into several categories based on their features, cases of use and adoption:

- Altcoins : Alternative cryptocurrencies for Bitcoin, such as Ethereum, Litecoin and Monero.

- Intelligent contract platforms (SCPS) : projects supporting decentralized applications using blockchain technology.

- Payment networks : Blockchain based payment systems such as Ripple or Stellar.

- tokenized assets : Digital assets representing physical goods or real estate.

Cryptocurrency risk

While the cryptocurrency market offers high potential phrases, it is also associated with a significant risk:

- Volatility : Price fluctuations can be extreme, which leads to significant losses.

- Risk of liquidity : Low turnover and limited access to markets may make it difficult to quickly leave your position.

- safety risk : private keys and portfolio safety are crucial; Unauthorized access can cause significant losses.

investing in cryptocurrency

If you are thinking about investing in cryptocurrency, remember this:

- Educate yourself : Understand cryptocurrency technology, their use cases and market dynamics.

- Set clear goals : Define your investment goals, risk tolerance and time horizon.

- Dize your portfolio : Spread your investments into many assets to minimize the risk.

- Be on a regular basis : Continuous monitoring of market trends, regulatory changes and technological progress.

Application

Understanding the complex dynamics of cryptographic space is crucial for anyone who has invested in this rapidly evolving market. By recognizing key indicators, categorizing cryptocurrencies and risk recognition, you will be better prepared to move around the constantly changing landscape of investing cryptocurrencies.

Because the market is still developing and maturing, it is necessary to remain on a regular basis, flexible and future.