Cryptocurrency Price Management Strategies to negotiate Litecoin (LTC)

The world of cryptocurrency trade is becoming increasingly popular as many investors strive to take advantage of the rapid growth and volatility of the market. One of the most significant cryptocurrencies in this space is Litecoin (LTC), a point -point -point electronic cash system aimed at faster and more efficient than traditional trust currencies.

As a digital currency, Litecoin price movements are strongly influenced by many market participants, including merchants, investors and institutional investors. In this article, we will look at some effective action strategies for negotiating Litecoin using technical indicators and other tools.

Understand the price of Litecoin (LTC)

Before going into strategies, it is essential to understand how the price of litecoin behaves in real time. Here are some important features of the ditch of litecoin:

* Behavior at Access

: LTC usually shows provincial behavior where prices usually remain at a certain intervals.

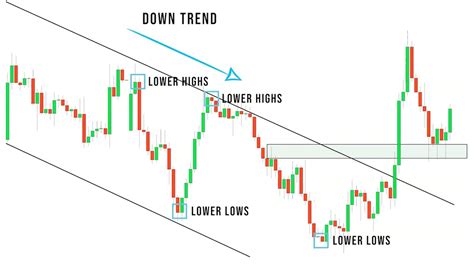

* Trend reversal patterns : LTC tends to show itself after you have experienced low trend or show low emotions while reversing the tendencies and growth of the presence of optimistic feel.

* Support and Resistance Levels : Litecoin price contains a number of important levels of support and resistance that merchants must be aware of.

Price management strategies to negotiate litecoin

Now, to understand the trench of litecoin, let’s look at some effective price -listing strategies for the cryptocurrency discussion:

- Trend following the strategy

Use the following trend approach to identify the price movement of litecoin. Find clear levels of support and resistance as well as possible reversal patterns. If the price shows a strong level, it may indicate that the trend has changed.

Example: If the price of Litecoin is currently increasing and has reached the high nearly $ 190.00, consider the purchase at this time to take advantage of the upward moment.

- Strategy limited to

Merchants who prefer provincial strategies focus on identifying support areas and resistance in specific litecoin bands. When prices enter these lanes, merchants can buy or sell at specific levels.

Example: If Litecoin enters a 10 -day interval (for example, $ 240-250) with a high at nearly $ 245, you can consider purchase if the price increases further.

- Discussion of candle patterns

Litecoin pricing can be analyzed with various candle patterns. Here are some popular:

* Hammer (high reverse pattern): If the price of litecoin is close to nearly $ 200.00 and then falls back to $ 190.00 before reaching the 20 periods of a moving average, you can indicate the potential purchase signal.

* Shooting Star : If the price of litecoin rises and then interrupts the resistance level, this may indicate the potential sales signal.

Example: If the price of Litecoin reaches approximately $ 200 and the 20 periods of 20 periods are below this level, you can consider purchase.

4.

This strategy includes the use of two or more moving averages to identify buy and sell signals. The transition between the two moving averages is an important indicator of snapshots.

Example: If the price of Litecoin exceeds the moving views of the 50 periods, this may indicate the potential purchase signal. On the other hand, if it is crossed below the 50 periods’ average, consider the sale at this time.

5.

This strategy includes a fall in litecoin prices and then wait for the prices pre -sale or pre -sale.

Example: If the price of Litecoin falls below $ 150 and returns to $ 155, consider the purchase if you continue to grow.