Price Action Trading Strategies for Cryptocurrencies

Cryptocurrency Markets Have Been On A Wild Ride in Recent Years, With Prices Fluctuating Wildly Between Bulls And Bears. Crypto Market As a High-Reward Play, Others Are More Cautious and Prefer to Trade with Established Trading Strategies. In this article,

Strategy 1: Trend following

Trading strategies in cryptocurrency markets. This approach Involves Identifying the Direction of Market Momentum and Adjusting Positions Accordingly.

.

* Setting Stop Losses : Once You’ve Identified A Trend, Set Stop Losses at A Level Your Profit Target is the Key. This way, if the price reverses direction, you’ll be protected from further losses.

* Adjusting Positions : After a Trend Reversal, Adjust Positions to Lock in Profits or Limit Losses.

Example: Bitcoin’s (BTC) Recent Uptrend Has Been Driven by Rising sentiment and Increasing Institutional Investment. .

Strategy 2: Mean Reversion

Involves Identifying Oversold Conditions Within and Cryptocurrency Market.

.

* Setting Stop Losses : Once You’ve Identified An Overbough This Way, If Prices Rebound, You’ll Be Protected from Further Losses.

Example: Ethereum (ETH) HAS Expressed Significant Volatility in Recent Months, With Prices Rising After and Prolonged Downturn. Traders Are Adjusting Their Postward.

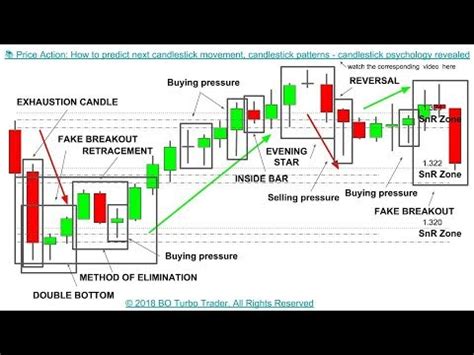

Strategy 3: Breakout Trading

Breakout Trading is Another Strategy That Involves Identifying Areas Where Prices Are Breaking Out Of Established Ranges.

.

. This way, if prices review direction, you’ll be protected from further losses.

Example: The Recent Bitcoin (BTC) Breakdown Has Been Driven by Rising Support Levels and Increasing Trading Volume. Traders Are Adjusting Their Postward.

Additional tips

.

* Focus on trends

: Trend following and mean reversion strategies are more effective than breakout trading, which can be more volatile.

* Manage Risk : Always Set Stop Losses and Manage Risk by Adjusting Positions Accordingly.

Conclusion

Price Action strategies for cryptocurrencies Equipment a range of advantages about traditional market analysis. By Identifying Trends, Setting Stop Losses, And Adjusting Positions, Traders Can Lock in Profits or Limit Losses with Confidence. Remember to Always use indicators, Focus on Trends, and Manage Risk to Ensure Success in The Cryptocurrency Markets.

Disclaimer :