To complete the risk assessment of cryptocurrency investments

Cryptocurrencies like Bitcoin and Ethereum have been a huge popularity in recent years as they are high income. At the same time, as in all investments, cryptocurrencies have risks that investors need to consider before the decision is made. In this article, we discuss how to evaluate the risk assessment of investments in cryptocurrencies, including the identification of important risks, understanding market fluctuations and choosing appropriate investment strategies.

To understand the risks of investing in cryptocurrency

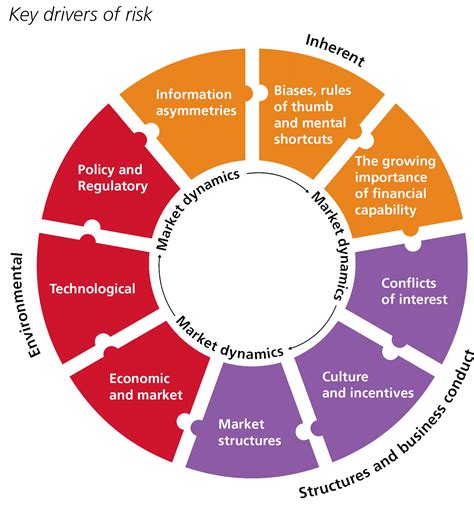

Cryptocurrencies are known to their volatile nature, which can result in significant price fluctuations in a short time. This unpredictability makes the risks of investors related to cryptocurrency investment. Some of the most important risks are as follows:

1.

- Regulatory Risks

: Changes in regulations or policies that regulate cryptocurrencies can influence their value and usability.

- Safety risks : Computer attacks, hackers and other security violations can result in investment loss.

- Liquidity risks : Cryptocurrency may not have enough liquidity to buy or sell quickly if necessary.

To perform risk assessment

Follow these steps to assess the risk assessment of investments in cryptocurrencies:

- Set investment goals : Before selecting cryptocurrencies, determine your investment goals and tolerance to the enterprise.

2.

- Evaluate the characteristics of cryptocurrency : Evaluate the characteristics of each cryptocurrency, including their security, scalability and use properties.

- Understand the risk of liquidity : Evaluate the liquidity risks related to each cryptocurrency, including commercial amounts and market emotions.

- Evaluation of regulatory risks

: Regulatory developments of research that can affect cryptocurrencies and their adoption.

To identify key risk

Some important risks should be taken into account when investing in cryptocurrencies:

1

Volatility : Cryptocurrency prices can flowarily float due to market emotions and external factors.

- Security Risks : Computer attacks, hackers and other security violations can result in investment loss.

- Liquidity risks : Cryptoracks does not have enough liquidity to buy or sell quickly as needed.

- Regulatory Risks : Changes in regulations or policies that regulate cryptocurrencies can influence their value and usability.

To select appropriate investment strategies

To reduce risks, choose the appropriate investment strategies that are aligned with your risk tolerance and investment goals:

- Diversification : Distribution of investments in different assets to minimize risk.

- Risk Management : Complete Risk Management Techniques such as Stop-Forda Requests or Cover Strategies.

- ** Long Focus -Alide a long -term perspective to release market fluctuations.

Best practices to invest in cryptocurrencies

To ensure a successful cryptocurrency investment:

- Do your search : Do complete research on each cryptocurrency before investing.

- Set clear goals and risk tolerance : Before selecting cryptocurrencies, determine clear goals and risk tolerance.

- Use a technical analysis : Use a technical analysis to identify trends and samples.

- Be informed : Be aware of market developments, regulatory changes and other factors that may affect cryptocurrencies.