How to identify the inverted models in the price operation

The cryptocurrency markets are known for their great volatility and unpredictable price movements. One of the most important strategies used by merchants and investors is to determine the inversion of price management. In this article, we examine how to identify the inverted samples in the operation of cryptocurrency prices, using various technical and technical indicators for diagram analysis.

What are the inverted models?

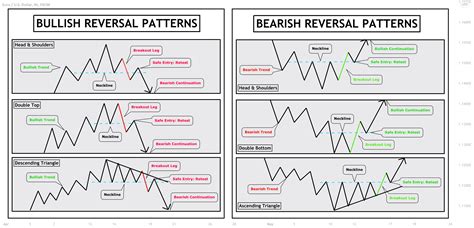

The inverted samples refer to a repeated repetition of a specific sample of a particular price movement, which indicates the potential reversal of the current trend. These samples can be identified as soon as possible, from a few minutes to years. The inverted models occur when the price reaches a certain level, then begins to move in the opposite direction.

Types of inverted models

Traders are looking for many types of inverted samples:

1 and 1

2

- Double TOP / Double lower : two consecutive points high or low at the same level.

4

How to identify inverted models in the price of cryptocurrency

Here are some steps that you can follow to identify the inverted models in the action of the cryptocurrency:

- Choose a trading plan : Before starting a trading strategy, it is essential to have a clear plan to identify the inverted models.

- Use diagram analysis tools : Use diagram analysis tools such as candlestick diagrams, line diagrams and mobile averages to display price movements.

- Determine the reversal of the trend

: Find signs of trends, including the formation of the head and shoulders, inverted triangles, models of upper / lower and flag.

- Analyze the candlesticks : Analyze the models of candlesticks such as candles, Doji candles and flooded candles to identify the potential opposite points.

- Use the indicators : Use technical indicators such as RSI, MacD and Bollinger bands to confirm inverted signals.

- Find confirmation signals : Find signs of confirmation on other deadlines or graphic models to validate the opposite signal.

Example of the reverse model of the price of cryptocurrency

Take into account the example of head and shoulder models in the action of the Bitcoin price:

- A simple mobile line (SMA) of 14 periods is represented and weak.

- The price reaches the top and then falls to the bottom.

- The price forms two lower levels of lower level.

- The price increases as the head approaches.

In this case, the head and shoulder model indicates that the price is reduced by decline upwards. This inverted sample can be used to buy or sell cryptocurrencies.

Tips and variations

Here are some tips and variations to identify inverted models of cryptocurrencies:

* Use several deadlines : Use several deadlines such as diagrams of 1 hour and 4 hours to identify potential reversal points.

* Combine the indicators : Combine several indicators, such as RSI and MacD to confirm the inverted signals.

* Find the examples of rehearsals : Find the examples of rehearsals where the same model occurs in a certain time.

* Use volume candles : Use volume candles to identify potential translation points.

Conclusion

The identification of the inversion of the price of cryptocurrency can be a challenge, but it is essential for merchants and investors who want to make well-founded investment decisions. By using technical indicators and diagram analysis techniques, you can increase your chances of identifying profitable trading options.